Just How To Obtain Authorized For A Bad Credit Report Lending

Authored by-Thorhauge Stallings

If you have a bad credit report and also need a lending, a negative credit score Finance may be the best option. These financings are unprotected as well as will certainly call for a debt check, but they will not influence your rating. Nonetheless, there are two various kinds of credit history checks. Soft credit score checks are completely harmless, while tough credit report checks can have an unfavorable effect on your rating. So it is important to know the distinction between both. If you wish to obtain authorized for a negative credit rating Finance, you must first know the benefits and drawbacks of each kind of lender.

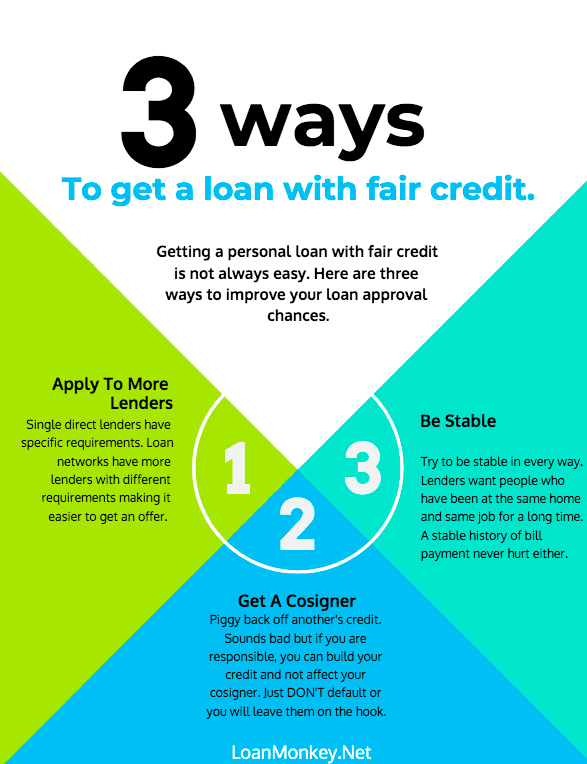

While many companies may be reluctant to supply car loans to those with negative credit scores, there are a couple of methods to enhance your score. One method to do this is to pay your expenses on time. The good news is, there are plenty of on the internet lenders that agree to offer you cash even if your credit report is less than excellent. By staying on par with your settlements, you can raise your credit report and reduced your APR. Nevertheless, the very best means to do this is to settle your Loan completely in a timely manner, which will certainly enhance your credit report.

Unsafe personal lendings are an additional alternative if you have inadequate debt. While these car loans commonly lug greater rate of interest, they are more inexpensive than other finances. You can utilize them as an emergency Financing for a range of objectives, like spending for unanticipated medical expenses or making large acquisitions. If you are not able to settle the Loan on schedule, loan providers may offer the debt to a debt collection agency, take you to court, or offer your financial obligation to a 3rd party. You can anticipate to obtain the money the next organization day, depending on the lending institution.

Take care with fraudsters. There are a great deal of fraudsters around claiming to be lenders, as well as they can capitalize on your scenario by offering you a finance. So before obtaining a poor credit rating Lending, make certain you do your research to make certain that you are dealing with a legit loan provider. Examine the conditions of the lender. Do decline the initial deal you receive. You can continue to shop around until you find the one that fits your needs.

If you require a funding as well as have poor credit, you can resort to a lending institution that concentrates on poor credit history loans. Several lenders specialize in this kind of Funding, and also can work with consumers with less than ideal credit report. When picking a lender for a bad credit scores Loan, you should do some research online. Search for referrals from friends and family. Using a website like BadCreditLoans.com will guarantee you get the money you require within the shortest possible time.

When requesting https://charis2alexa.werite.net/post/2022/07/12/How-To-Obtain-A-Bad-Credits-Lending rating Loan, the lending institution will assess your earnings, employment condition, as well as assets. The loan provider will certainly make use of these info to establish the amount of cash they agree to offer. If guaranteed bad credit approval loans don't have adequate earnings to meet the payment demands, you may require to borrow greater than you can manage. Yet poor credit history lendings might be the best option if you're desperate for cash money. As well as if you're unsure what sort of bad credit history Funding you need, below are some suggestions:

Using online for a poor credit history Funding is basic and secure with a business like WeLoans.com. This solution matches you with loan providers based upon your criteria. And also the very best component is that the entire procedure is totally free - the internet site only charges charges associated with Funding offers. With its totally free solution, you can locate the ideal Funding for your demands. The prices are extremely affordable for the negative credit lending industry. You can stand up to $5,000 on this website if you need to.

These fundings are an amazing choice for individuals who have inadequate credit scores as well as need cash right away. These fundings fast and also simple to obtain and have a great deal of company behind them. Financial institutions will normally inspect your credit score record and also your FICO rating, however many of these companies want to offer you a no credit report check Loan. If you can show your earnings, you should have the ability to safeguard the money you need, and afterwards get the Loan. You do not require a credit history to obtain a poor credit Loan.

Get More Information are another excellent choice for obtaining fast money. Poor credit report loans are commonly paid back in dealt with month-to-month settlements and can be utilized to satisfy personal costs. These fundings can be secured or unsafe. When choosing a negative credit score Loan, bear in mind that each kind has pros and cons. If your score is 579 or less, you need to choose the unsafe alternative. You may have to do some credit history repair work prior to you can obtain approved. A good area to start is credit history therapy.